Companies rated investment grade expressed reluctance to issue convertible bonds, despite favorable conditions.

It can be a nonstarter to raise the topic of convertible bonds with treasurers at investment-grade companies that can already issue debt with very low interest rates and don’t want their stock diluted when investors convert bonds to equity.

- But many NeuGroup members whose companies have high credit ratings, including some at a recent meeting of NeuGroup for Capital Markets, say all their banks have pitched convertibles. And some treasury teams are also getting questions internally from CFOs and board members.

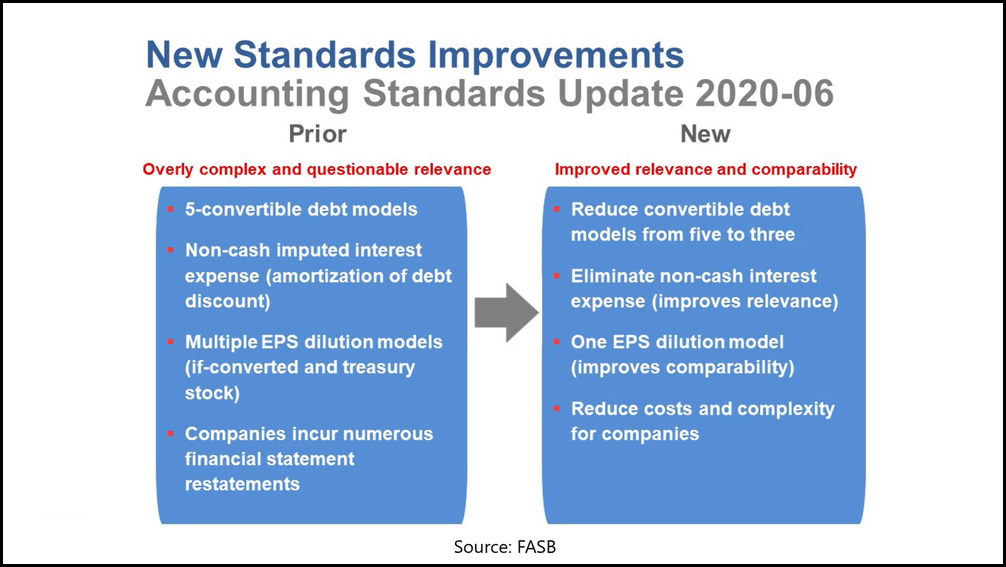

- One member, echoing others, said 0% coupons and conversion premiums in the range of 50% to 70%, along with updated FASB accounting standards (see chart) that could simplify the process, makes convertible bonds “more attractive, but it’s an odd gamble when rates [for straight debt] are below 3%.”

Companies rated investment grade expressed reluctance to issue convertible bonds, despite favorable conditions.

It can be a nonstarter to raise the topic of convertible bonds with treasurers at investment-grade companies that can already issue debt with very low interest rates and don’t want their stock diluted when investors convert bonds to equity.

- But many NeuGroup members whose companies have high credit ratings, including some at a recent meeting of NeuGroup for Capital Markets, say all their banks have pitched convertibles. And some treasury teams are also getting questions internally from CFOs and board members.

- One member, echoing others, said 0% coupons and conversion premiums in the range of 50% to 70%, along with updated FASB accounting standards (see chart) that could simplify the process, makes convertible bonds “more attractive, but it’s an odd gamble when rates [for straight debt] are below 3%.”

Ideal conditions. One member with experience issuing convertibles before his company became investment grade said the most difficult part of the process was documentation, so the simplification by FASB is significant.

- The FASB changes come amid market factors that have historically been good for convertible bond issuance:

- Low interest rates

- High equity prices and high valuations such as PE (pricing/earnings) ratios

- High volatility levels

- These condition have sparked a flood of companies with non-investment grade ratings, or no ratings, to issue convertibles. The Financial Times, citing Refinitiv, reported that in January and February, companies raised almost $34 billion, 68% more than in the first two months of 2020.

Dilution. The big downside to convertible instruments, NeuGroup members said, is dilution of a company’s common stock, which potentially makes the shares less valuable to shareholders.

- “If the stock price goes to 10% above my strike price, my upper bounds, I’m diluting myself $4 billion, is that really worth 20 basis points of savings?” one member asked. “Your base is much higher because your company has doubled the wealth, but you still have to explain why you’ve taken $4 billion of dilution.”

- The same member said, “As much as banks love to pitch convertibles because they can charge [more than for straight debt deals], some of our closest banks have been honest and been like, ‘You’ve heard about convertibles a lot I’m sure, but we don’t recommend them for investment-grade companies.’”

- Another member added, “Some [banks] said, ‘If your stock goes up by a hundred percent, are you really still going to be worried about dilution?’ Economically, yes, I will.”

- “I’ll echo those thoughts,” another member said. “Although there is great headline attractiveness, 50 basis points is not worth the risk of dilution.”

Pair convertible with a buyback? One member raised the intriguing idea of pairing a convertible issue with a stock repurchase plan to offset or hedge the dilution of additional stock. The member, however, said he’s still too skeptical of convertibles to embrace the strategy.