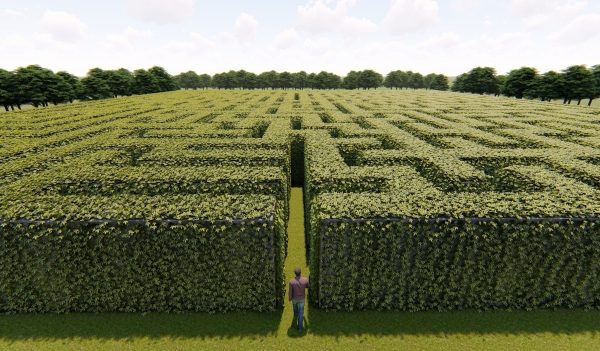

Streamlining a hedging portfolio can seem daunting, but there are advantages for corporates that take the plunge.There’s a growing trend among corporates to take a new look at existing financial risk management programs. Some of the triggers for review are explicit events, such as financial reporting results or restatements, or changes in key personnel. But many companies are finding that longstanding hedging programs may just no longer meet the original program objectives, or may have grown in silos and created…