As it enters the corporate cash management market, Goldman looks to revolutionize virtual accounts with better tech, more familiarization and streamlined processes.

Goldman Sachs is entering the cutthroat and increasingly crowded world of corporate cash management determined to play the role of innovative disruptor—no easy task. A cornerstone of Goldman’s strategy is a product whose name is familiar to many corporate treasury professionals but that is not fully understood by all of them: virtual accounts.

That state of affairs has put Mark Smith, Goldman’s Transaction Banking head of global liquidity, on a mission to answer every question treasury teams have about virtual accounts, particularly as the bank has just launched its own Virtual Integrated Account (VIA) offering in the US, with plans to roll it out internationally later in 2020. “Virtual accounts are a foundational product for us and we’re conscious that awareness and understanding of them is inconsistent,” Mr. Smith says. “We’re here to change that.”

The Basics

Virtual accounts began in the Asia-Pacific region in the early 2000s and started being used extensively in Europe in the last 10 years. In the last five years, they’ve become more mature in Europe, where there is less dependency on cash. They’re a relatively new concept in the US, presenting Goldman with an opportunity to help corporate treasurers who are seeking more efficient liquidity solutions.

“At their most basic,” Mr. Smith says, “virtual accounts are simply a way of organizing and reporting data within a real bank account.” Traditionally, he explains, companies have organized cash flow information by having separate physical bank accounts. He cites an example of a corporate with 10 divisions, with each division having its own bank account; in this instance, the cash balance, incoming receipts and outgoing payments can be tracked for each. “But that means maintaining 10 bank accounts,” Mr. Smith says. One alternative is to have one bank account and tracking information on an Excel spreadsheet with 10 tabs. The trouble with the Excel model is that “correctly allocating the incoming receipts and outgoing payments can be time-consuming and error-prone.”

Unique Identifiers

Virtual accounts organize data within a bank account so that it looks as if it’s divided into mini-accounts or sub-ledgers (i.e., virtual accounts). Just like a real bank account, each virtual account has an opening balance, a closing balance, incoming receipts and outgoing payments. The key to achieving this is assigning a unique identifier to each incoming receipt and outgoing payment so that the bank’s VIA solution can attribute it to the correct virtual account, and in turn the bank account with which it is associated. These identifiers can be reference numbers, in which case each payment instruction needs to contain the real bank account number and the reference number.

Alternatively, the virtual account identifiers can be configured as a clearing-recognized account number, such as an International Bank Account Number or IBAN. This method means that the payment instruction only needs to contain the clearing-recognized account number; no additional reference number is required. When the bank receives the incoming payment, the VIA system automatically posts it to the relevant real bank account and (simultaneously) reflects it in the correct virtual account. Virtual accounts and the real account are always kept in sync.

Mr. Smith says the benefits of the reporting capability of virtual accounts have helped fuel their growth among corporates. This is particularly true in Europe, where many cite the typical treasury need for better control and visibility over cash and liquidity. But the potential of virtual accounts goes far beyond reporting and visibility.

Rationalization

Virtual accounts are a great tool for tackling the challenge of bank account and bank rationalization. Treasuries worldwide have witnessed a proliferation of bank accounts over the past several decades as customers and supply chains have expanded globally. This has brought with it the time and cost required to open and maintain all those accounts.

With virtual accounts, once the master physical account has been established, any number of virtual accounts can be opened—all with minimal additional documentation, if any. This will be one of the main features of Goldman‘s VIA offering. “The Goldman Sachs offering is self-service, putting the full power and flexibility of virtual accounts in the hands of the treasurer,” Mr. Smith says. This means treasurers “can effectively open and close virtual accounts instantly, and update hierarchies in real time. It’s a totally different experience to managing traditional bank accounts.”

In certain situations, virtual accounts can eliminate and replace real bank accounts, but with no loss of reporting detail. What’s more, Mr. Smith asserts that a virtual account could end up costing at most a tenth of what a traditional account would cost—and in many cases, virtual accounts may be free altogether. Consequently, rationalizing traditional accounts into virtual accounts should save both time and money.

Goldman Sachs’ offering can also function across ERP systems. This means users will have the ability to send information using all industry formats; it’s also API-enabled and integrated across all the firm’s product offerings, real time if required. This is unlike incumbent payment mechanisms, which many banks use, and which use a host-to-host connection or node. Moreover, once the SWIFT structure is implemented, it’s hard to change.

Eliminating Much of the Manual

Arguably the most documented use case for virtual accounts is in receivables management, which is how virtual accounts got started in Asia over a decade ago. Virtual accounts address an inherent problem with traditional receivables structures in which many receipts are received into one bank account, requiring significant manual intervention to reconcile.

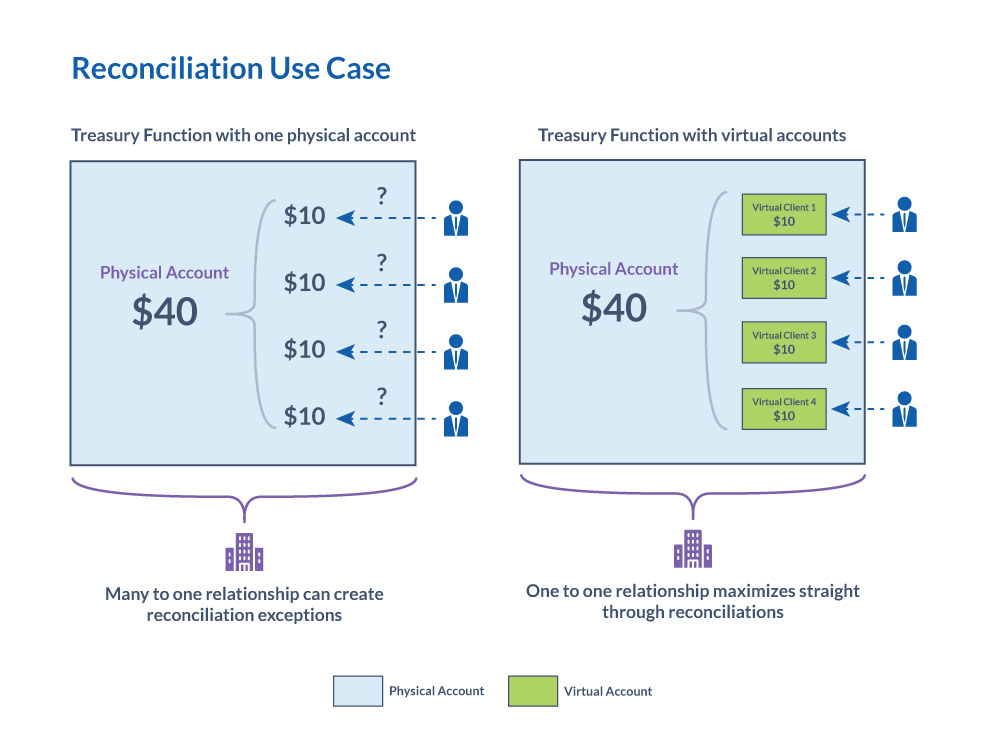

Breaking up a traditional bank account into virtual accounts can, Mr. Smith says, drive much higher rates of straight-through reconciliation if, for example, one virtual account is assigned per client. Reconciling receipts vs. open accounts receivable in the one-to-one relationships in virtual accounts is, Goldman says, more straightforward than in the “many-to-one” relationships typical in traditional account structures.

Nikil Nanjundayya, Goldman’s Transaction Banking head of emerging products, says that using virtual accounts this way eliminates the need to dedicate personnel to manual reconciliation, resulting in potentially significant cost savings. Furthermore, faster reconciliation can mean faster cash application and better working capital availability. Faster reconciliation can even lead to a better client experience.

Transaction Banking is business of Goldman Sachs Bank USA (“GS Bank”) and its affiliates. GS Bank is a New York State chartered bank and a member of the Federal Reserve System and FDIC, as well as a swap dealer registered with the CFTC, and is a wholly-owned subsidiary of The Goldman Sachs Group, Inc. (“Goldman Sachs”). Transaction Banking services leverages the resources of multiple Goldman Sachs subsidiaries, subject to legal, internal and regulatory restrictions. Transaction Banking has compensated NeuGroup for their participation in the drafting of this white paper.

© 2020 Goldman Sachs. All rights reserved.