FX meeting sponsor Standard Chartered: Hedge policy flexibility may decide if volatility is treasury’s friend or foe.

Volatility in foreign exchange, commodity and other markets sparked by the pandemic presented risk managers with challenges to their hedging programs. And while some corporates ended up with financial pain, others turned the volatility to their advantage.

FX meeting sponsor Standard Chartered: Hedge policy flexibility may decide if volatility is treasury’s friend or foe.

Volatility in foreign exchange, commodity and other markets sparked by the pandemic presented risk managers with challenges to their hedging programs. And while some corporates ended up with financial pain, others turned the volatility to their advantage.

- At a recent meeting of NeuGroup for Foreign Exchange sponsored by Standard Chartered, a representative of the bank used the positive experience of one member to underscore the benefits of hedging policies that give risk managers flexibility in how and how much to hedge, and for how long.

What you need to take advantage. “The volatility we’ve seen has been advantageous,” said the member. “We’re coming at it from a different perspective.” Unlike many members who have long exposures, in most countries, the company “is short, selling dollars, buying local currencies,” she explained.

- The member described her company’s hedging policy as “very flexible; we use forwards and options—zero cost collars.” Treasury also has flexibility in how much to hedge, all the way up to 100% of the company’s exposures.

- There are “no stipulations,” and the company’s traders “develop their own strategies” for hedging, she said.

- “Right now we’re experiencing positive OCI (other comprehensive income) and mark-to-market gains,” the member told peers. “This is a good story for us.”

Nimble and quick. Standard Chartered’s head of client analytics said that policy flexibility like what exists at the member company gives corporates the ability to be “nimble and quick,” adding that, “Volatility can be your enemy or your friend depending on your flexibility.”

- In addition to a flexible policy, an efficient trade approval process for trades also allow risk managers to add “interesting hedges to capture the volatility and momentum” of markets roiled by news and events, she said.

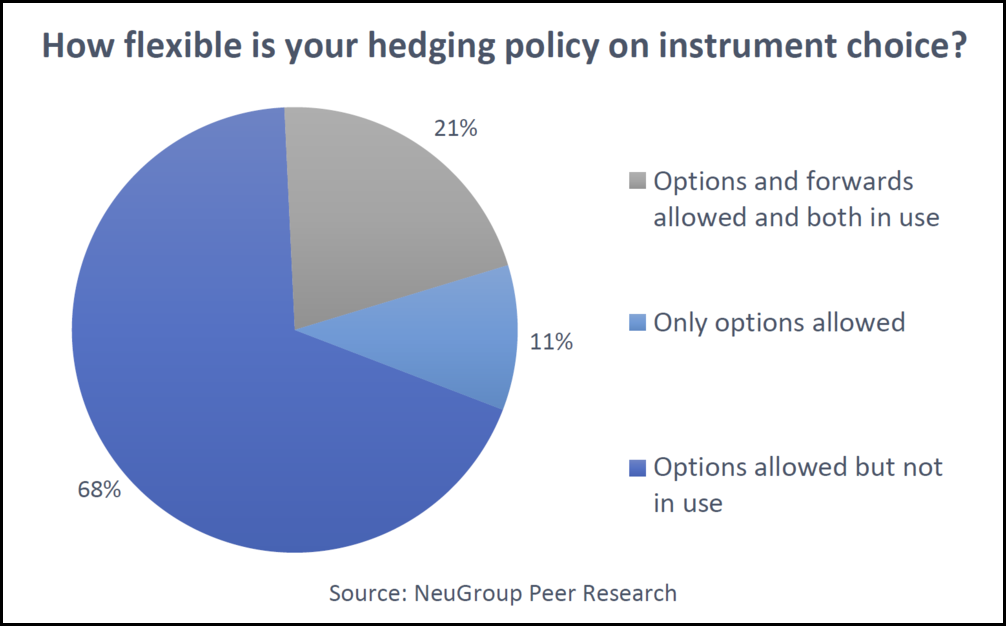

Options in theory, not practice. It appears that most risk management teams have the policy approval to use options in their hedging strategies but do not use them. As the chart below shows, about two-thirds of the companies surveyed at the meeting said options are allowed at their companies but are not in use.

Why not options? In response to questions from Standard Chartered, members gave several reasons why they are not currently using options to hedge risk other than the cost of option premiums:

- “We have approval to use from an accounting, auditor and policy perspective. But there still seems to be a stigma against them internally. We are self-insured, and options often feel like insurance, so it’s a culture thing. We just need a good business case to help us get to the finish line!”

- “It’s a corporate governance issue; it takes time and effort to get approval, but we want to.”

- “We’re trying to find the right time and haven’t found the right opportunity to dip our toes in.”

- “Showing the value [to senior management] is the hurdle.”