Goldman Sachs wants to show treasurers the multiple ways virtual accounts can help with efficiency in a variety of transactions.

Virtual accounts can help overcome a range of impediments when it comes to creating efficient and straight-through transaction processes. This is what has driven their growth from a simple receivables management tool to a multipurpose one that can help bank and bank account rationalization, on-behalf-of transactions and the once highly manual reconciliations process.

Payments/Receipts On Behalf Of (POBO/ROBO)

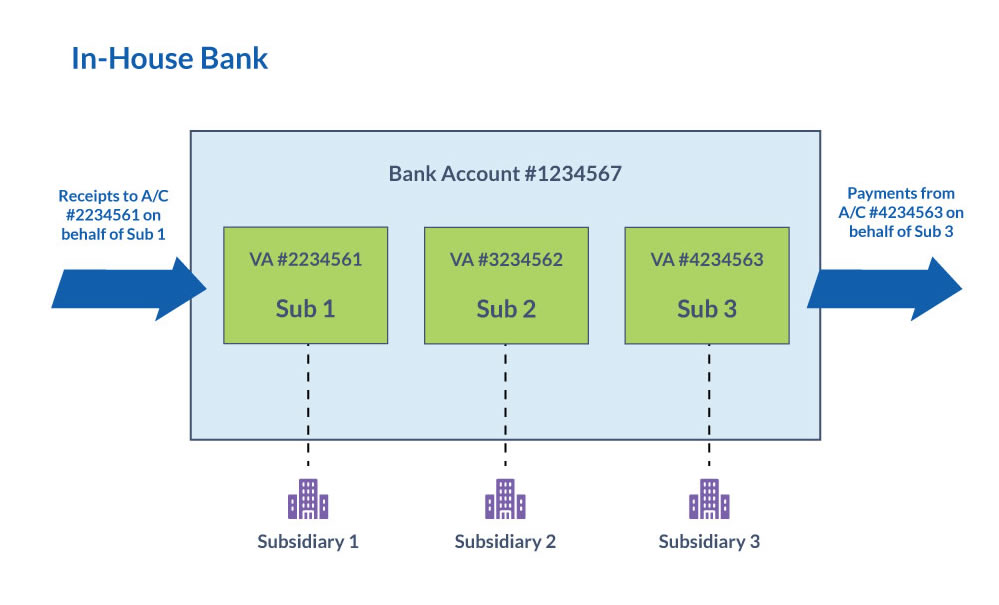

Virtual accounts can drive significant efficiencies within a given legal entity, but they can be a powerful on-behalf-of tool when applied to corporate structures, says Mark Smith, Goldman’s Transaction Banking head of global liquidity. Subsidiaries no longer need to maintain their own bank accounts. Instead, they can maintain virtual accounts with a parent entity or treasury center. In this case, the virtual account becomes an intercompany ledger, recording the parent entity’s or treasury center’s position with the subsidiary, as well as all the underlying transactions.

If a treasury center makes a payment on behalf of a subsidiary, that outgoing payment will bear the subsidiary’s virtual account number and will reflect simultaneously in that virtual account and post to the physical account. Incoming receipts similarly can be reflected on behalf of a subsidiary to the relevant virtual account.

While virtual accounts can drive POBO/ROBO structures, clients will still need to organize their payment and receipt operations centrally. This may require a time investment up-front, but the time and cost savings of POBO/ROBO structures will be well worth it and are well documented.

Virtual accounts can therefore sit at the heart of an in-house bank. Here, Mr. Smith is keen to reiterate the advantage of the Goldman Sachs virtual account offering. “Goldman virtual accounts can be configured to be clearing-recognizable, which some other in-house bank solutions cannot,” he says. He adds that that other “engines” for virtual accounts rely on reference numbers, but those numbers can be mistakenly omitted or transposed, resulting in the inefficiency of manual intervention.

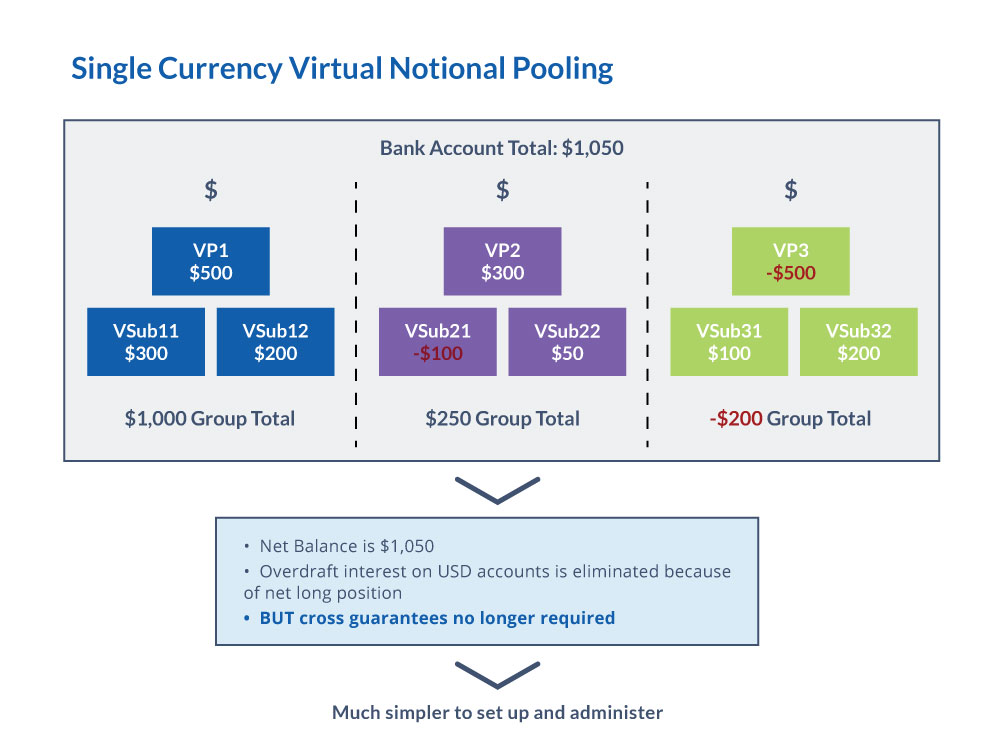

Some European banks, and even European corporates, believe virtual account structures may be a convenient way to address regulatory pressure on notional pooling. In Europe, Basel III requires capital to be held against the gross assets in a notional pool, not the net position. This has made notional pooling more expensive for capital-intensive European banks, which are subject to the supplementary leverage ratio; it has even called into question the future of notional pooling altogether.

“Single currency notional pools can absolutely be replicated virtually,” Mr. Smith explains. This is done by assigning virtual accounts to subsidiaries within the same physical accounts, he says. Mr. Smith adds that individual virtual accounts can be overdrawn, but if the physical account maintains a positive balance, no overdraft charges are incurred. The virtual pool is also self-funding and self-collateralizing. Crucially, only the net balance on the physical deposit is reflected for general ledger and regulatory reporting—including capital reporting. “There’s no risk of gross-up as you have with a notional pool,” Mr. Smith says. Finally, pooling in this way doesn’t require cross guarantees as the bank faces only the one physical bank account.

Pooling Not Out Completely

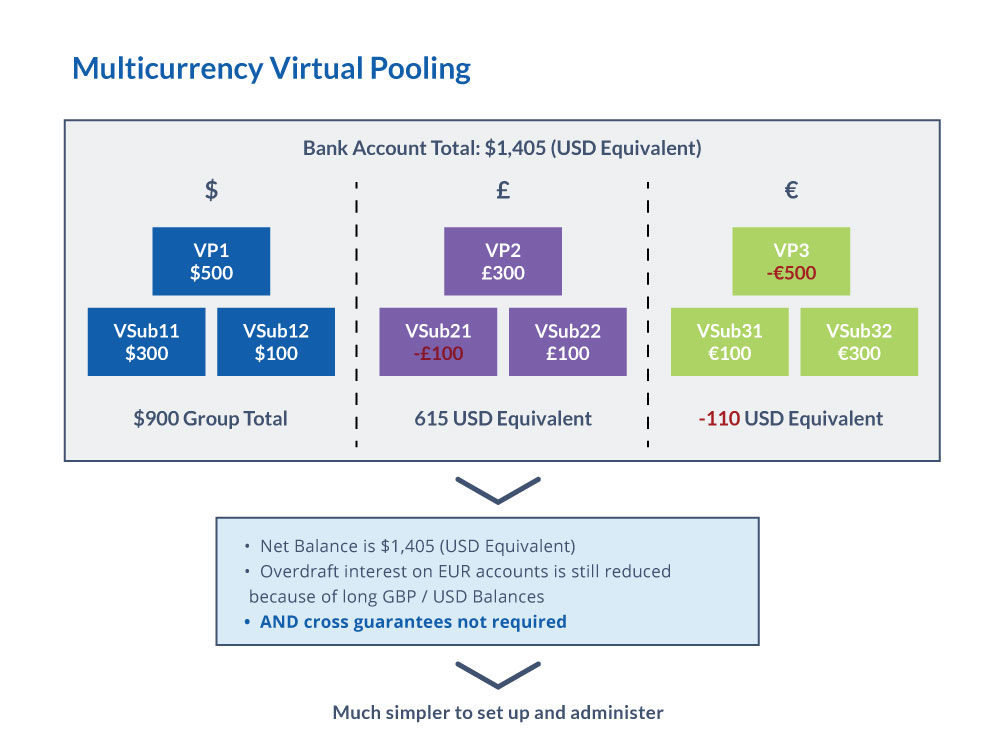

Virtual multicurrency notional pools should also be possible through multicurrency virtual accounts, in which the parent physical account is denominated in one currency while the virtual accounts represent wallets in different currencies. The currency balance on the virtual accounts is translated into the nominal currency of the parent account but isn’t converted via any FX trade—they remain in source currency. The economics should be like a traditional multicurrency notional pool, where net negative balances are charged a cost-effective collateralized overdraft rate. But again, cross guarantees aren’t required as the bank faces the net position on the parent physical account.

Because cross guarantees aren’t required, virtual notional pooling should be significantly more straightforward to establish than traditional notional pooling. Theoretically, more clients should be able to benefit from the cheaper funding costs and lower FX fees as a result, Goldman argues.

There is one important difference between traditional notional pooling and virtual notional pooling. In a traditional notional pool, there are no intercompany balances between entities. In a virtual notional pool, all participating virtual accounts represent an intercompany relationship with the entity that owns the physical account. For some corporates, avoiding intercompany balances is an important objective in pooling. Such corporates will need to weigh the potential advantage of avoiding cross guarantees against any potential disadvantages of intercompany balances.

KYC Questions

Both banks and their corporate clients have wondered whether virtual accounts can ease the burden of know your customer (KYC) and anti-money laundering (AML) rules when physical accounts are replaced with virtual accounts. The use of virtual accounts may streamline customer onboarding obligations, with a focus on the customer—the physical accountholder. Still, it is reported that in South America, local regulations are requiring KYC by legal entity. “A certain level of due diligence will always be required on any participant in the US financial system, whether they participate physically or virtually,” says Nikil Nanjundayya, Goldman’s Transaction Banking head of emerging products.

Mr. Smith and Mr. Nanjundayya maintain that Goldman’s VIA is cutting-edge, and will continue to evolve, offering a best-in-class user experience, including full self-service capability as well as the ability to scale. As Mr. Nanjundayya explains, “Clients can open a million or more virtual accounts effective instantly themselves, should they need to—and to close them.” Further, he says, Goldman Sachs clients will be able to structure accounts into hierarchies and adjust those hierarchies using the same self-service capability. This ability to scale isn’t possible with traditional bank accounts, Mr. Nanjundayya says. Additionally, traditional cash structuring, including account opening, typically involves more engagement with the bank than is necessary with virtual structuring.

But Goldman doesn’t just want to be at the leading edge when it comes to virtual accounts; it wants to define that leading edge and drive it forward. “We are also future-proofing our product,” Mr. Nanjundayya asserts. While the bank is not willing to divulge specifics, Goldman’s offering will include capabilities expanding into FX, analytics, cross-border activity and even M&A management.

It’s All About the User

Goldman believes that the benefits of virtual accounts can benefit all clients and that its offering is not a segment-specific solution. That means it is flexible and can be adapted to corporates that have a variety of use cases, i.e., different corporates will use the accounts in different ways. For example, a property manager may use them to track the cash flows for each building, while a software company may use them to manage developer payments.

Migrating to virtual accounts need only be as complex as changing bank accounts, although structuring them into more sophisticated solutions will need careful planning in partnership with the bank. However, the benefits of moving to virtual accounts should outweigh the costs many times over, Goldman says. In short, the bank says that virtual accounts should be at the heart of treasury transformation.

Transaction Banking is business of Goldman Sachs Bank USA (“GS Bank”) and its affiliates. GS Bank is a New York State chartered bank and a member of the Federal Reserve System and FDIC, as well as a swap dealer registered with the CFTC, and is a wholly-owned subsidiary of The Goldman Sachs Group, Inc. (“Goldman Sachs”). Transaction Banking services leverages the resources of multiple Goldman Sachs subsidiaries, subject to legal, internal and regulatory restrictions. Transaction Banking has compensated NeuGroup for their participation in the drafting of this white paper.

© 2020 Goldman Sachs. All rights reserved.