BlackRock CEO Larry Fink shared insights on ESG, D&I and American capitalism with NeuGroup members and guests.

BlackRock CEO Larry Fink recently addressed treasurers attending a special session moderated by NeuGroup CEO Joseph Neu that touched on topics including ESG, diversity and inclusion, corporate purpose and American-style capitalism. Among many highlights, Mr. Fink said he is actively urging world leaders to agree on a common set of metrics to judge progress on climate change.

BlackRock CEO Larry Fink shared insights on ESG, D&I and American capitalism with NeuGroup members and guests.

BlackRock CEO Larry Fink recently addressed treasurers attending a special session moderated by NeuGroup CEO Joseph Neu that touched on topics including ESG, diversity and inclusion, corporate purpose and American-style capitalism. Among many highlights, Mr. Fink said he is actively urging world leaders to agree on a common set of metrics to judge progress on climate change.

- “We need every country to come together on one taxonomy,” Mr. Fink told members of NeuGroup for Mega-Cap Treasurers and NeuGroup for Tech Treasurers. “If you really are earnest in moving the world to net zero [carbon emissions], we need to have proper measurements that are measurements we can all do together,” he said. “That’s the only way public companies are going to be properly judged.”

- Mr. Fink said he’s making the case to politicians attending the next UN climate change conference,COP26, in November. “I’m constructive on this, but we’re not going to get there unless there are long-term policies by governments. We’re not going get there if we don’t have a global taxonomy.”

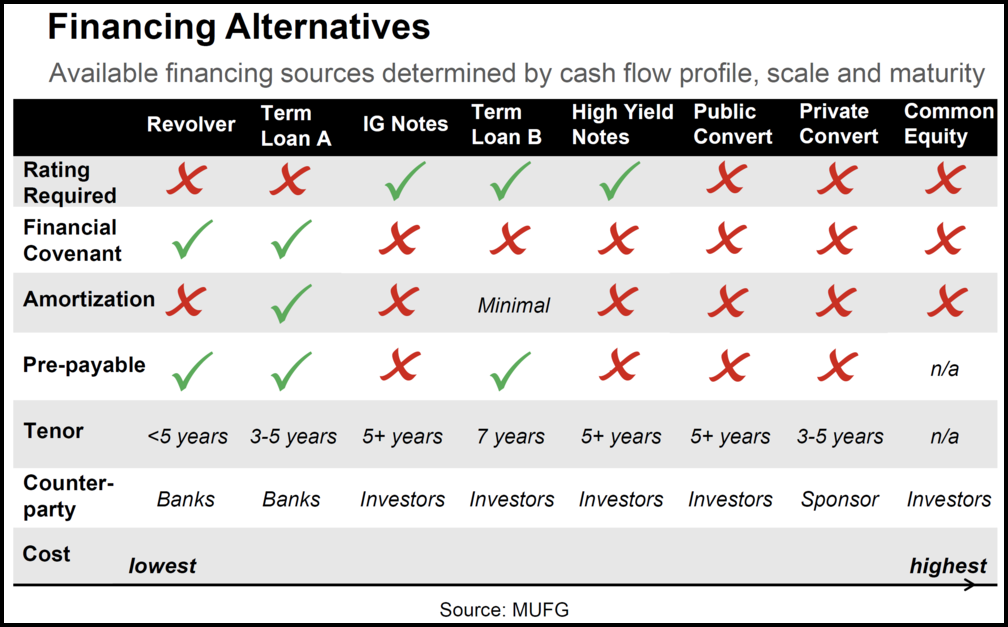

Better environmental scoring, analytics. The lack of standards underlying ESG scores frustrates many corporate risk managers. Mr. Neu described a cash investment manager at a recent NeuGroup meeting who said, in essence, “I see these ESG scores but I don’t really know what to make of them.”

- Mr. Neu asked Mr. Fink for his thoughts on “how we can bring these metrics on par with the more traditional metrics including credit ratings, so we get over this hurdle of thinking differently about fiduciary responsibility and stakeholder ESG responsibility?”

- In his 2021 letter to CEOs, Mr. Fink reiterated BlackRock’s desire that all companies report in alignment with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB), which covers a broader set of material sustainability factors.

- “As more and more companies report under TCFD and SASB, we have better analytics at the corporate level, Mr. Fink said. “And through better reporting and more transparency we are, in a short period of time, going to have much better data and analytics to do environmental scoring.”

- Also: “The Biden administration is making this a priority and everybody should expect that we as public companies are all going to be asked to report our ESG data, if you’re not doing it already. So you might as well just get it done. Which is going to be good. We’re going to be able to analyze every company and how they’re moving forward.”

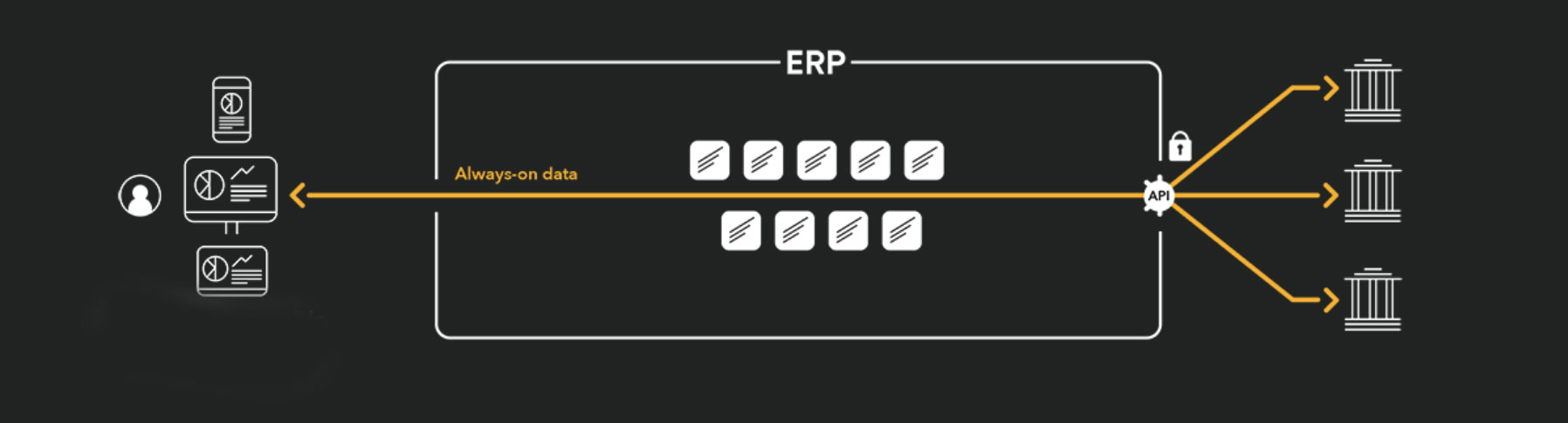

The Aladdin advantage. Mr.Fink gave participants a preview of a new tool BlackRock will use to analyze the climate risk posed by companies and, by extension, the credit risk of their securities and assets. It’s called Aladdin Climate and is in the beta stages, due to be unveiled in the fall.

- “This is probably the biggest ESG-related project that we have going on in BlackRock right now to develop the technologies and algorithms to really understand and to quantify why we believe climate risk is investment risk,” he said. “We’re trying to ‘Aladdinize’ the physical impact of climate change and transition risk associated with the energy transition, so that we can analyze them like we would analyze duration risk, convexity risk, credit risk. We believe that is going to be very important component of investing in the future.”

- “We have onboarded satellite imaging technology onto our risk management platform with algorithms on climate change movements,” he explained. This will allow investors and risk managers to evaluate the transition risks of a portfolio. “We believe this is going to be one of the biggest opportunities in the investment world, for treasurers, for CFOs.”

Proud of American capitalism. Coming out of the pandemic in the US,“I’m more bullish on American-style capitalism than ever before,” Mr. Fink told members. “You have to be really proud of American capitalism.”

- “American capitalism was so successful, despite the pandemic in 2020. When you think about our capitalism and the ability to create a vaccine in 10 months…it’s an amazing story. But that’s the beauty of America, the beauty of the country’s ingenuity.”

- Beyond ingenuity, today’s companies need to have leaders who pursue a corporate purpose that benefits all stakeholders. Mr. Fink said, “I do believe that some of the best companies in America today are companies who have a strong, well-articulated purpose— and some of those companies are on this call right now.”

- He added, “Society is asking more and more of public companies. Public companies are now becoming the big drivers that move society forward.”